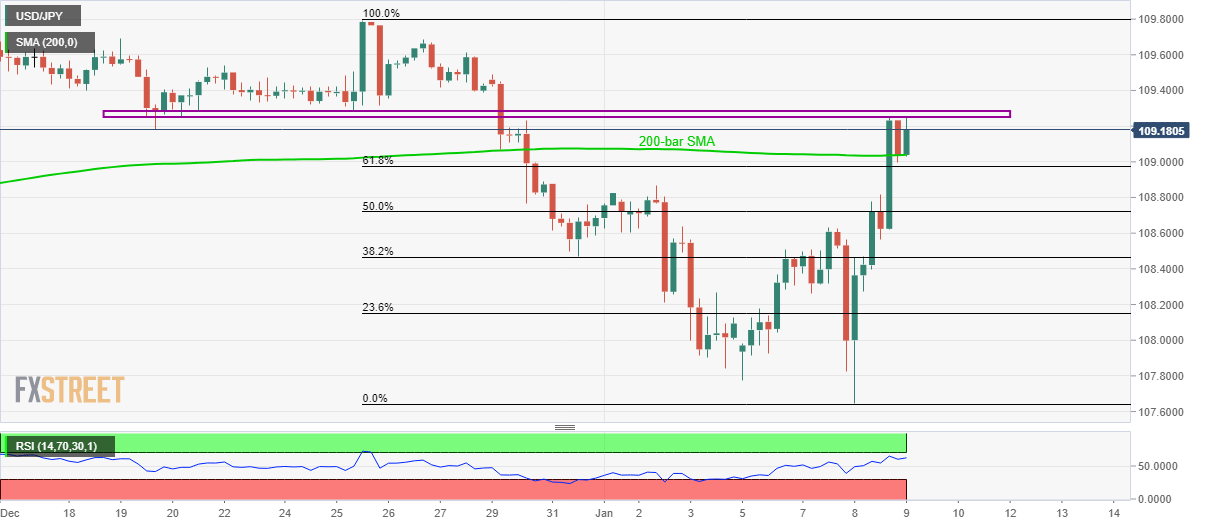

USD/JPY Technical Analysis: Struggles to stretch the recovery beyond 109.25/30

- USD/JPY stays above 200-bar SMA after Wednesday’s sharp recovery.

- Multiple lows marked during late-December cap immediate upside.

- Overbought RSI signals the pullback, sellers can revisit Tuesday’s top during decisive declines.

USD/JPY holds onto recovery gains from Wednesday while taking the bids to 109.20 during early Thursday. The pair remains above 200-bar SMA while confronting near-term key resistance area.

Considering the overbought conditions of RSI and the strength of multiple lows marked between December 19 and 25, buyers will wait for a sustained break of 109.30 before taking a fresh entry.

In doing so, 109.60 and the Christmas 2019 high of 109.80 could be on their radar ahead of 110.00 round-figure.

Alternatively, sellers can sneak in if the quote slips below 200-bar SMA level of 109.00, which in turn will highlight early-week top near 108.60 as the follow-on support.

Should there be increased selling pressure below 108.60, 107.80 and the recent low near 107.65 will return to the charts.

USD/JPY four-hour chart

Trend: Pullback expected