US Dollar Index looks weaker, breaks below 92.00 to new 4-week lows

- DXY breaches the key support at the 92.00 mark.

- US 10-year yields look consolidative around 1.25% post-FOMC.

- Flash Q2 GDP, weekly Claims, Pending Home Sales next in the US docket.

The greenback remains on the defensive and now drags the US Dollar Index (DXY) to the sub-92.00 region, or fresh multi-week lows.

US Dollar Index offered on steady Fed, looks to data

The index sees its decline accelerated and drops below the 92.00 mark for the first time in several weeks, as market participants continue to digest Wednesday’s steady hand by the Federal Reserve.

In fact, US yields grinded lower and the dollar intensified the selloff after the Committee noted no urgency in start tapering the QE programme at its meeting on Wednesday. In addition, the FOMC did not show extra concern over the risks surrounding inflation or the prospects for economic growth.

The Committee also acknowledged the progress of the economy as of late, adding that it will keep assessing the performance of the economy in the next months.

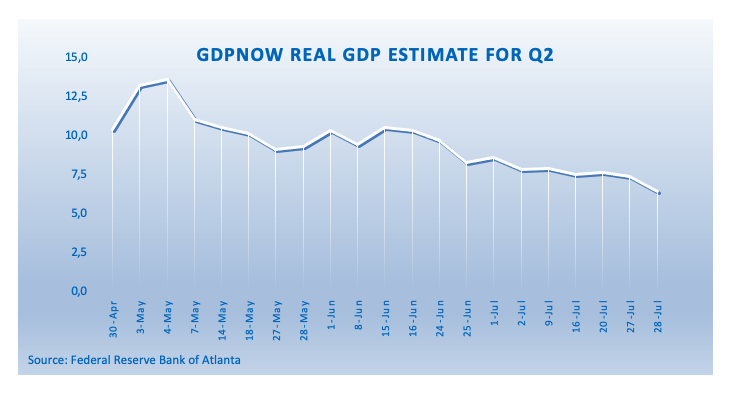

In the US data space, the focus of attention will be on the release of the advanced Q2 GDP figures seconded in relevance by Initial Claims and Pending Home Sales.

What to look for around USD

DXY’s selloff manages to re-test the 92.00 neighbourhood after dollar-bulls were disappointed by the inconclusive (dovish?) tone at the FOMC event on Wednesday. A clear direction in the price action around the buck is now expected to emerge after the post-FOMC dust settles. In the meantime, bouts of risk aversion in response to coronavirus concerns, the solid pace of the economic recovery, high inflation and prospects of earlier-than-expected QE tapering/rate hikes should remain key factors supporting the dollar.

Key events in the US this week: Flash Q2 GDP, Initial Claims, Pending Home Sales (Thursday) – PCE/Core PCE, Personal Income/Spending, Final July Consumer Sentiment (Friday).

Eminent issues on the back boiler: Biden’s multi-billion plan to support infrastructure and families. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Debt ceiling debate. Jackson Hole Symposium.

US Dollar Index relevant levels

Now, the index is losing 0.27% at 92.01 and faces the next support at 91.98 (monthly low Jul.29) seconded by 91.51 (weekly low Jun.23) and then 91.34 (200-day SMA). On the upside, a break above 93.19 (monthly high Jul.21) would open the door to 93.43 (2021 high Mar.21) and finally 94.00 (round level).